清华五道口金融学院 “一带一路”金融科技高级研修项目 | Belt & Road Fintech Advanc

云计算、大数据、区块链、人工智能等技术的蓬勃发展,给金融行业带来了颠覆性的变化。中国一直走在金融科技的世界前沿,涌现出一批如蚂蚁金服、京东金融、人人贷等优秀企业。金融科技行业机遇与风险并存,监管部门也面临着新的挑战。

清华大学五道口金融学院一直致力于金融科技的研究,推动金融与科技的融合,加强业界、学界和监管层的交流。一带一路金融科技课程是全球首创的全面解读金融科技发展和监管的课程。

本课程将由在金融科技领域具有多年研究和实践经验的资深教授、监管领导、投资人和创业者授课。除了理论知识的学习,课程同时设计了课堂分享和公司参观环节,让学员们亲身感受金融科技的创新与发展,提供身临其境的学习体验。

课程目标

本课程旨在帮助学员:

了解“一带一路”倡议下东南亚与中国的经济发展

了解金融科技的发展历程与主要商业模式

了解金融科技监管原则与思路

解读新形势下金融科技的发展趋势和投资机会

目标学员

东南亚地区金融监管机构决策者

金融机构高层管理者

金融科技领域的创业者及投资人

电子商务/互联网企业高管

谋求跨界发展的企业家

课程信息

课程地点:北京

课程时间及周期:

模块一:2018年4月 4天

模块二:2018年6月 4天

授课语言:英文

课程体系

中国经济与“一带一路”政策

中国宏观经济分析

“一带一路”倡议解读

“一带一路”倡议下的投资机会

中国金融市场概况

金融科技商业模式

传统金融的互联网化(互联网银行、券商、保险)

基于互联网平台开展金融业务(互联网资产管理、消费金融、商业贷款、金融产品销售)

全新的金融科技模式(P2P网络借贷、众筹)

金融科技信息服务(在线投资社交、在线社交投资、金融产品搜索、个人金融信息管理、在线金融教育)

金融科技基础技术

金融大数据的应用

区块链技术与应用

金融科技监管

金融科技征信体系建设

中国金融科技监管原则与思路

金融科技投资

东南亚金融科技论坛

金融科技企业走访

*根据情况选取4-5家企业

Technology innovations in the digital age, including cloud computing, big data, blockchain, AI and others have triggered a new revolution in the financial industry. China now is a global leader of financial technology (Fintech) with many well-known fintech companies emerging out, such as Ant Financial, JD Finance, renrendai.com, rong360.com and CreditEase. Great opportunities are always accompanied with great risks. The booming fintech industry in China also poses regulatory challenges for the government.

Tsinghua PBC School of Finance (PBCSF) provides a good platform of strengthening communication among business leaders, scholars and regulators in fintech research and practice. Its specially-designed Belt &Road Fintech Advanced Program is the first fintech program of this kind in the world to comprehensively study the development trends of fintech and regulatory environment.

The program is taught by distinguished scholars from Tsinghua PBCSF, regulators and industry leaders, in collaborated with world established think tanks. The program is designed to provide participants a first-hand understanding of fintech beyond books and theories with more interaction among a diverse profile of participants. The program also focuses on providing more opportunities for dialogues, networking events and field visits in order to achieve a highly effective way of experiential learning.

Program Objectives

Gain more understanding of China and ASEAN Countries’ economy under the “B&R ” Initiative

Understand the development and main business models of fintech

Understand the regulatory polices of fintech

Discover more investment opportunities in fintech

Targeted Participants

Ocials from regulatory authorities of ASEAN countries

Executives of financial industry in ASEAN countries

Entrepreneurs and investors in fintech industry

Leaders of e-commerce and Internet companies

Entrepreneurs who seek for new opportunities

Program information

Program Venue: Beijing

Program Date:

Module 1: 4 days, April, 2018

Module 2: 4 days, June, 2018

Program Language: English

Lectures and Visits

China’s Economy and Belt and Road Policy

China’s Macro Economy

Interpretation of Belt andRoad initiative

Investment Opportunitiesunder the B&R initiative

Overview of China’sFinancial Market

Fintech Business Models

Digitalization oftraditional finance(online bank, online broker, online insurance)

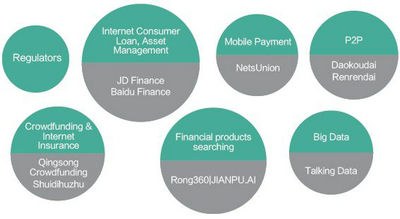

Finance based on internet(online asset management,online consumer financing, online loans, online sales of financial products)

New fintech models(P2P, crowdfunding)

Fintech informationservice(online investment network,online social investment, financial products searching, personal financialinformation management, online financial education)

Fintech fundamental technology

Financial big data and itsapplication

Blockchain technology andits application

Fintech Regulation

Establishment of fintechcredit system

Fintech regulatory policyin China

Fintech investment

Southeast Asia fintech forum

Fintech company visit

*Select 4-5 companies to visit

- 09-11 清华五道口金融EMBA招生详情

- 09-04 清华经管EMBA招生人群/招生条件信息一览

- 09-04 清华五道口金融EMBA原来是这样招生的

- 08-16 已公布!清华五道口金融EMBA招生信息、学制学费

- 04-19 聚焦金融创新与实体经济发展 --清华金融EMBA福建同学会学习活动